Ever since I opted for voluntary retirement from my job (a responsible, high paying job and a professional assignment) because of domestic issues in my family, I knew I am going to face hardships in my life due to less income (the only income from the interests accrued on fixed deposits).

There was little or no alternative for me but to face it. I took this as a challenge to overcome this problem boldly.

Inspired by the famous quote “Difficulties mastered are opportunities won” I decided to swim against tough times using all my work experience and evolved a 6 point strategy to live happily with less money.

“Living with less but living financially free from debts and worry” was my motto from then onwards.

But before that…

Introduction to what people think about money.

Lack of money is stressful. It is quite normal to feel worried, anxious at difficult times. Job insecurity, redundancy, debt, and financial problems can all cause emotional distress.

Managing money during;financial problems without stress is a challenge.

Do you know 76% of the people in the world identify money as a significant cause of stress in their lives? Why is it so?

Money related stress is not just about a shortage of Dollars/Rupees. It is more than that. Instead, the culprit is the way we think about and interact with money.

The obvious solution is to add more money, but this may be a temporary escape from the crisis. In return, anxiety crops up abruptly. All that is required is to think differently about money and bring in your positive approach in dealing with the crisis.

If you are poor, little more money can give you everlasting happiness. In a country that is economically growing, if you have a place to live with the ceiling fans to beat the heat it sounds satisfying.

On the other hand, if all your basic needs are satisfied, then do you feel more money can buy more happiness? Not necessarily, youcertainly robbed of all the happiness that you are longing.

Fighting for money can drain the joy out of anyone’s marriage life, ceasing friendly ties with your friends and relatives. Chasing after money can also severely cost you of all the opportunities to concentrate on the most important moment in life.

It is unfortunate, that we have so many people in the world crazy after money and are willing to part anything in exchange for money.

The truth is that if you have better control over your finances and ways to manage money; you have less money stress in life.

Obviously, no stress means happy living. The secret is that if you have full control over your investments, you can choose to save money.

Saving your money at a time when you have good earnings can reap benefits at times of hardships. You need not have to beg or borrow with anyone. This is the biggest drudgery.

So...

How to enjoy life with less money

Follow these 6 steps on how to cope up with money stress when you have less money

- Organize your spending:

- Sensible Spending

- Stop using credit cards: I am not against using credit cards. Use them very judiciously. It is true that credit cards help make buying very easy, and normally end up making too much buying. Not only that, if you skip your payments beyond the due dates you are penalized with very high interest. This means you are paying extra for the item purchased which otherwise, you would have spent for something else useful.

- Do it yourself: Hiring someone to help you get something done, is costly and wasteful expenditure. Make an attempt to do it yourself. If you really value the extra money you spend on such activities you would definitely learn them faster and enjoy the savings accrued. Keeping yourself engaged in physical activity is a healthy choice. You can also enhance your knowledge. I was unnecessarily paying high car wash rates. When I realized this I started washing my car myself once a week.

- Cook your own food and do not eat outside:

Depending on outside (restaurant) foods is the most expensive activity. When

you eat in a restaurant, you pay not only to the food but also for the cost of

running the restaurant (overhead charges). Over and above this you need to also

commute to a decent restaurant which involves cost. So it is better to cook

your own food and save on restaurant bills.

Stick on to simple meal choices and plan them well in advance. I always prepare my menu plan every Sunday for the following week. - Quit unhealthy habits: Unhealthy habits are those that directly affect your health like smoking, drinking liquor, chewing scented beetle nuts, tobacco, etc. Buying these products is costly and may not suit your budget and there is every chance to fall sick and pay huge medical bills. This is again a burden on your limited income.

- Minimize Debt

- Stop adding debts to the ones you have already: Adding debt while you are paying it off is very risky. You cannot make much progress in reducing debts. The first thing you should do here is to control your credit purchases that create additional debt on your already existing debts by canceling all your credit cards.

- On-time, payment of bills is the only way to have control over your expenses. If need be barring the essential items cut down all unnecessary expenses that eat away your income.

- Be choosy in spending to compensate the amount you need to repay. Preferably, a discussion with your family members to explain the need for controlled spending can be helpful.

- Start paying more than your minimum monthly payments: If you pay only the minimum monthly payments, you will be tied in your debts for a long time. By the time you come to the end of the debts, you would have paid two to three times the originally charged bill amount. So, plan and start paying higher amounts than the minimum monthly amounts to close the debts faster.

- Set aside an amount from your regular income to meet unexpected expenses: By doing this you are creating a cushion to meet debts instead of digging your savings account. I started setting aside 20 % of my salary towards emergency fund at an early age itself. I even opened a separate savings bank account in a different bank. I also ensured that this emergency amount appreciated over time because of the higher interest rates received on the principle amount.

- Organize a debt payment strategy: By this, I mean you work out a plan to concentrate on the highest debt account first. Start paying off a higher monthly amount to this account while you still pay a minimum monthly on other accounts. This way you can complete the highest account first followed by the next highest.

- Save money

- Sincere Goal setting

- Learn to be content with what you have.

You do not need any sophisticated tool or a professional to support you. All you need a sort of system that is simpler to work with and monitor.

Let it be a system that flashes you the moment anything goes out of your control.

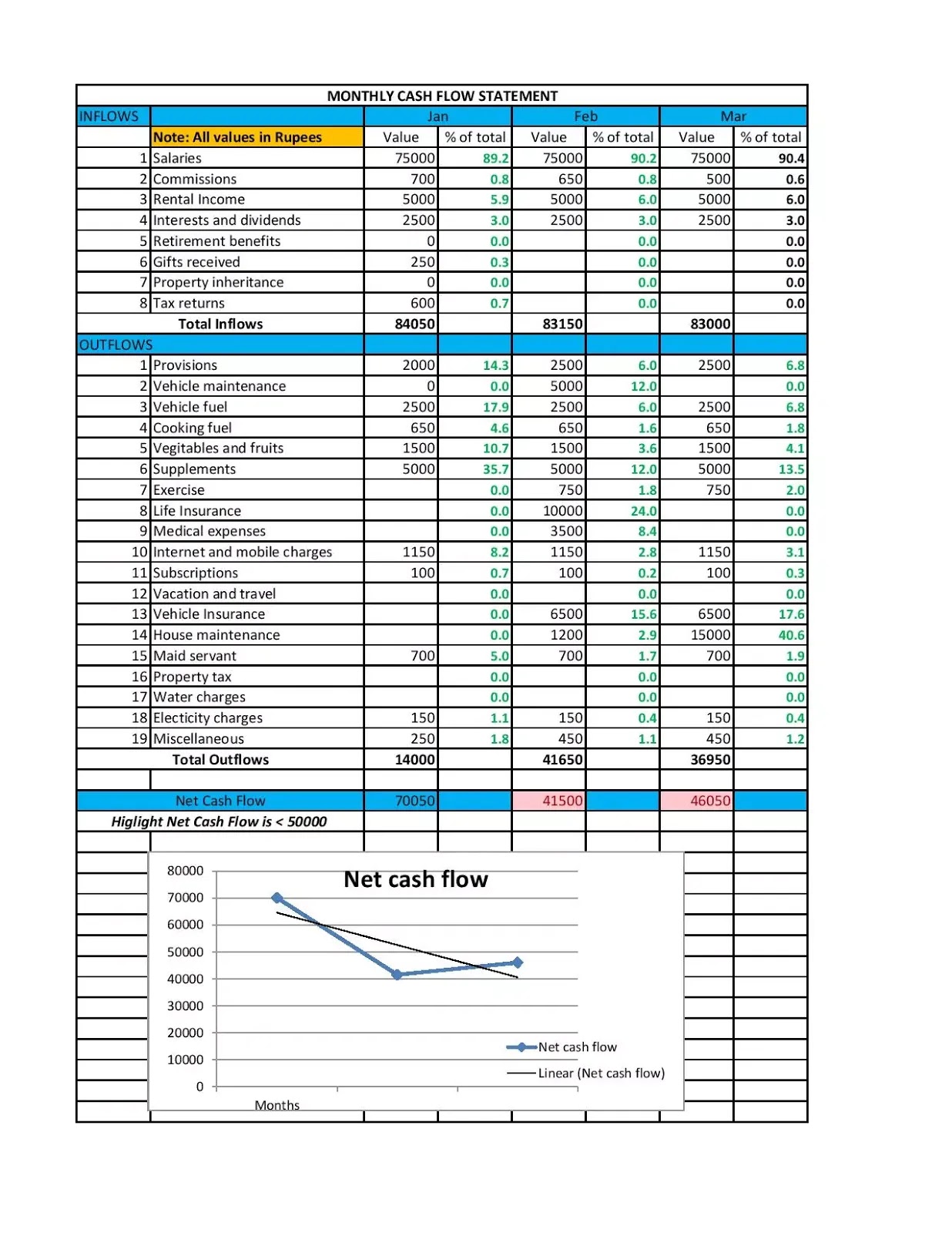

Concentrate on the four basics Income, Expenditure, Debts, and Savings. You can have internal splits against the main headings.

For instance, while Expenditure is the main heading, Fuel expenses, Phone bills, medical expenses, etc are the subheadings.

As you fill-up, the expenses and debts calculate also the percentage of the income spent. This can be your matrix for identifying the highest to the lowest contributor of your expense.

Benchmark a percentage value of expenses above which you need to keep a watch to curtail them.

A month-wise monitoring graph would be ideal to flash you the expenditure trends. This is an interesting tool to keep you abreast of your financial position anytime.

You also need to have a mechanism to tally the figures updated on this sheet. Spend every day 15 minutes to browse through the expense register to find out any abnormal expenses.

At the end of the month summarize the month’s expenses and compare it with the previous month and before. Notice the trend and identify expenses that are increasing or steady in nature. These systems will give the most likely answer to curtail any avoidable expenses.

I use the below template to organize my spendings.

Click here to view the infographic in seperate window and enlarge

To download this template, please click the download button

Share this Image On Your Site

Monitoring expenses, identifying unwanted expenses, finding out ways and means to curtail these expenses is a key factor to live with less money

If you have trouble living within your means, you need to identify the expenses that pinch your pocket the most. Simply scan through your last month's expenses. Perform a Pareto analysis (80: 20 Principles) “Twenty percent of the items that contribute 80 percent of the total expense by value”. This is a principle to prioritize your expenses.

Curtailing unwanted usage of your vehicle even short distance can reduce your fuel consumption. This is a great portion of the monthly expense. Likewise, there are many ways to cut down unnecessary expenses to live with less money (within your means).

Tips for sensible spending that I practice to come out of my rising expenditures

These are a few of my suggestions on how to live with less money. You can use your own logic and find out how you can cut down expenses.

Critically examining the high expense areas and working out a strategy to minimize such expenses needs to be practiced continuously once monitoring begins. Actions to curtail high expense areas should be taken immediately to see the benefits in the following months

In today’s economy, affording a house, or planning for a renovation in the house has become a dream. One needs to depend on loans. So, this way you get into debt and satisfy your dreams, but at the same time, it is difficult to pay it off quickly. The presence of debts for a long time becomes very much bothersome and therefore you need to close the debts as soon as possible in order to live life debt-free. Therefore, careful planning for eliminating debts should be organized.

Tips for reducing debts

By being conscious about the consequence of increasing debt and making a plan to eliminate the existing debt gradually helps you to live happily without money stress

Another mental shift you must make to achieve financial freedom is to change your thinking about money from spending to saving. W. Clement Stone said that “If you cannot save money, the seeds of greatness are not in you.”

The moment you start saving money, you tend to have total control of your financial issues. You automatically start driving yourself to allocate a portion of your income towards a savings account. Arrange to deduct a sum from your income at the source itself, thereby preventing the temptation of spending. Joining a good-paying mutual fund scheme having a systematic investment plan would be ideal. Arrange a system, which automatically draws a portion of the money directly from your savings account.

The most important fact is that you can save if you are strong enough to live within the margin of your take-home income. This is a very difficult situation, but once you become a good financial manager, you can definitely save better. It is a practice evolved out of the experience. Therefore, budgeting, tracking your expense and paying your bills timely can translate better savings. Start with small level savings, the moment you see your savings account accumulating, this will tempt you to increase your savings level.

Apart from allocating a portion of your income (15% to 20%) to separate savings account, you need to also check ways to squeeze extra savings from your budget. See the infographic below.

Click here to view the infographic in seperate window and enlarge

Share this Image On Your Site

The moment you start saving money, you tend to have a total control on your financial issues. You achieve financial freedom because of the cushion that you have created financially to face all the odds.

The first step to getting what you want in life is to decide what you want. Visualizing what you want is the key to goal setting. The more practical you are in goal setting the more the chances of achieving your targets. Please bear in mind that along with goal setting you need also plan a roadmap to achieve them. This practice helps you to visualize your way to the goal. You may need many preparatory activities before you start.

It would be professional to write down your financial goals. Figure out the steps required to achieve them. Fragment them into manageable parts. For example, if your goal is to save rupees 1, 00,000 by next year. You need to work from now. Start calculating the amount saved per month and the amount saved per day. Roughly, per day rupees 300 would be a small amount. Try to find out which expense of yours avoided. Maybe your practice of having food outside with your friends can be avoided. Quitting bad habits like drinking, smoking can add to this amount. These are passive savings.

Lastly, a weekly review of your goal setting is necessary. This can give direction for your next week's plans.

The trick to this is to browse through your achievements periodically. This will give you encouragement to do more. Set your mind with minimum needs for contentment. Most people believe that money buys happiness, independence, security, and status. However, the irony is that these people have given money the power to control them. As a result, these people keep wanting more and losing control of spending.

The best way to take control of your spending is to adopt good practices of planning, organizing, and saving.

Conclusion

Boundaries make us free from anxiety, therefore they are life-giving.The enemy of life is forgetting our boundaries. Whether they are social, financial, or moral, boundaries provide well-structured ways to manage money and a guideline for life. Boundaries motivate us to discover happiness whatever be the current situation. As explained above careful spending plan is a helpful tool—the financial boundary helps us free from anxiety about money. It allows us to recognize we do not have to spend more money than we earn to be happy. There is no joy in living beyond your means—only stress. How to enjoy with less money requires dedication and patience to live within the boundaries of your income. In addition, find more life because of it.

Over to you now

Right now, I wanted you to do one thing:Specifically, I want you to leave a comment describing your opinion regarding leading a minimalistic lifestyle to live a life with less money

For example:

- Have you designed any system of your own to track and organize your spending?

- Comment on the net cash flow statement mentioned in my blog?

- Any improvements you would like to suggest making it still better?

- What strategy do you follow to generate savings in your personal life?

- Comment on the savings plan mentioned in my blog?

- Any other observation and experiences you would like to share with me after you have decided to live a minimalistic lifestyle. I’ll be glad to learn from you and add them as an update to this blog.

PS: If you got anything from this post, Tweet

Image by succo from Pixabay

Image by mustofa agus tri utomo from Pixabay

No comments:

Post a Comment